Introduction to Bengaluru-Based Startups and Funding

Bengalurubased 23m seriesdilipkumarmoneycontrol, often hailed as the “Silicon Valley of India,” is a hotbed for innovation and entrepreneurship. The city boasts a dynamic startup ecosystem, attracting entrepreneurs, investors, and tech enthusiasts from around the globe. Series funding, particularly the recent $23M Series led by Dilipkumar, plays a crucial role in propelling these startups toward growth and sustainability.

Bengaluru’s startup environment thrives on a unique blend of talent, technology, and investment. From small-scale operations to globally recognized unicorns, the city has proven its mettle time and again. Series funding acts as the lifeline for these companies, providing the financial muscle needed to scale operations, enhance product offerings, and capture larger markets.

Overview of the $23M Series Funding

Key Players and Stakeholders

The $23M funding round is a testament to the growing confidence investors have in bengalurubased 23m seriesdilipkumarmoneycontrol startups. At the forefront is Dilipkumar, a renowned investor whose keen eye for potential has consistently transformed small ventures into industry leaders.

Role of Dilipkumar in the Funding Process

Dilipkumar’s involvement signifies a blend of strategic foresight and robust financial backing. His contributions go beyond capital, offering startups mentorship and market access.

Highlights from Moneycontrol’s Coverage

Moneycontrol has extensively covered the nuances of this funding round, emphasizing its significance for the region’s economic landscape. From interviews with stakeholders to data-driven insights, their reports have provided a comprehensive view of the funding’s impact.

Impact of the $23M Series on the Startup Ecosystem

Economic Implications for Bengaluru

The infusion of $23M is expected to generate employment, drive innovation, and elevate the city’s global stature as a startup hub.

Boost to Startup Innovation and Expansion

Funding of this magnitude enables startups to explore advanced technologies, enter untapped markets, and solidify their foothold in competitive sectors.

Case Studies of Similar Series Fundings in the Region

Historical funding rounds, such as Flipkart’s initial investments, offer valuable lessons in leveraging capital for growth, underscoring the transformative power of strategic funding.

Challenges and Opportunities in Series Funding

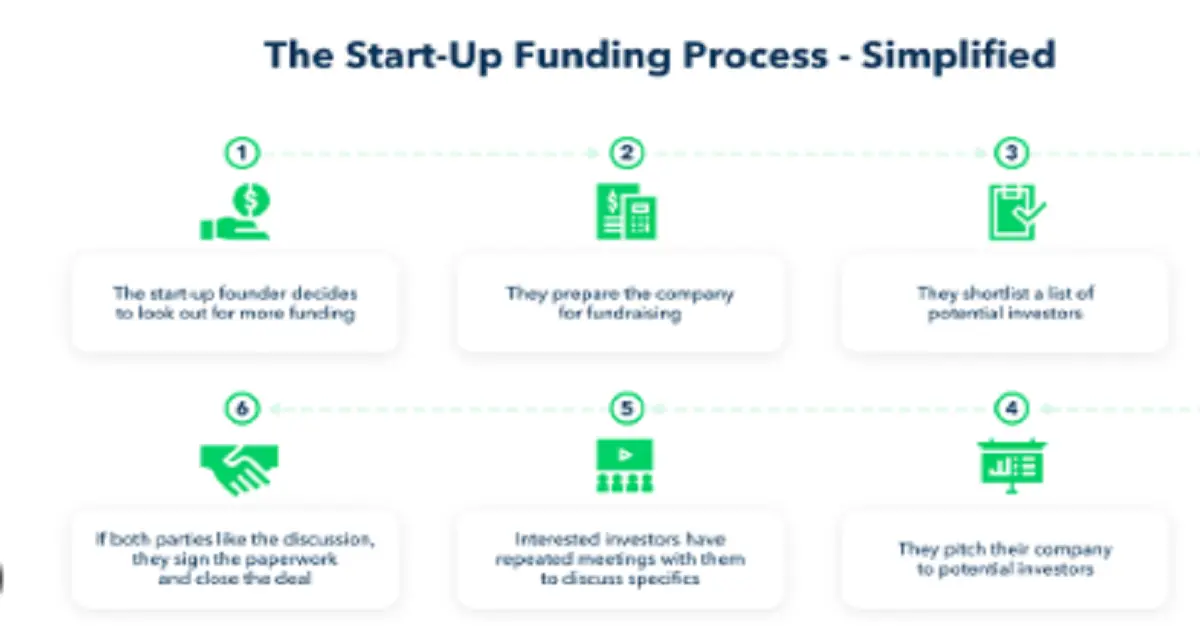

Common Hurdles Faced by Startups in Securing Series Funding

Startups often grapple with challenges like market saturation, investor skepticism, and regulatory hurdles, making series funding a demanding yet rewarding endeavor.

Strategies to Overcome Funding Challenges

Building a robust business model, demonstrating consistent growth, and fostering transparent communication with investors are critical to overcoming these barriers.

Emerging Opportunities in the Indian Startup Ecosystem

With initiatives like “Startup India,” the government is fostering a conducive environment, paving the way for more funding opportunities and collaborations.

Future Projections and Trends

Anticipated Growth in Bengaluru’s Startup Sector

As bengalurubased 23m seriesdilipkumarmoneycontrol continues to attract global investors, the city is poised for exponential growth, creating ripple effects across various industries.

Potential Influence of Investors like Dilipkumar

Investors with a proven track record inspire confidence and set benchmarks, encouraging more entrepreneurs to take the leap.

Role of Media Platforms like Moneycontrol in Shaping Public Perception

Media platforms amplify success stories and highlight challenges, fostering an informed and engaged startup community.

Broader Implications of the $23M Series

Catalyzing Entrepreneurial Growth in Bengaluru

The $23M Series funding round is more than just a financial milestone; it is a powerful signal to entrepreneurs in the city. By demonstrating that ambitious ventures can attract significant investment, this round encourages budding entrepreneurs to innovate and take calculated risks. Bengalurubased 23m seriesdilipkumarmoneycontrol rich ecosystem of accelerators, incubators, and tech communities provides the perfect backdrop for such transformative growth.

Ripple Effect on Ancillary Industries

Large funding rounds like this also boost ancillary sectors such as co-working spaces, legal advisory, and financial consulting services. These industries thrive alongside a booming startup ecosystem, creating a network of interdependent growth that benefits the city’s overall economy.

Promoting Cross-Industry Collaborations

With the influx of funds, startups often find themselves in a better position to collaborate with other industries, leading to innovations across domains like healthcare, fintech, education, and green technology. Such synergies amplify the impact of individual investments and drive collective progress.

Lessons from the $23M Series

The Importance of Strategic Leadership

Dilipkumar’s involvement underscores the critical role of strategic leadership in high-stakes investments. His ability to identify promising ventures and provide strategic guidance offers a blueprint for other investors looking to maximize returns while fostering growth.

Leveraging Media for Transparency and Trust

Platforms like Moneycontrol play a pivotal role in creating transparency around major funding events. By providing detailed analyses and stakeholder interviews, they help build trust within the community, ensuring that startups and investors remain informed and accountable.

Best Practices for Startups Aspiring for Series Funding

For startups aiming to replicate the success of those receiving significant funding, here are some actionable steps:

- Craft a Clear Vision: Investors are more likely to back startups with a well-defined mission and roadmap.

- Demonstrate Proven Traction: Showcasing early successes, whether through customer acquisition, revenue, or product innovation, builds credibility.

- Strengthen Core Teams: A skilled and motivated team can make all the difference when pitching to investors.

- Engage Early with Investors: Building relationships with potential investors long before the funding round begins can give startups a competitive edge.

- Embrace Financial Discipline: Managing resources effectively and demonstrating fiscal responsibility builds trust and confidence among investors.

A Call to Action for Future Investors

The $23M Series funding reflects a growing trend of high-value investments in India’s startups. It also highlights the role that investors like Dilipkumar play in driving innovation and economic growth. Future investors are encouraged to explore opportunities in bengalurubased 23m seriesdilipkumarmoneycontrol, a city that continues to redefine the entrepreneurial landscape with its boundless energy and ingenuity.

Conclusion

The bengalurubased 23m seriesdilipkumarmoneycontrol funding, led by Dilipkumar and extensively reported by Moneycontrol, is a landmark event in India’s startup narrative. It signifies not only the potential of the city’s entrepreneurial ecosystem but also the trust that global and domestic investors place in it. By addressing challenges, leveraging opportunities, and fostering collaborations, Bengaluru is poised to remain at the forefront of innovation and economic growth.

FAQs

What is Series Funding, and why is it important for startups?

Series funding provides the capital necessary for startups to scale operations and achieve sustainability.

Who is Dilipkumar, and what role does he play in the startup ecosystem?

Dilipkumar is a prominent investor known for his strategic insights and impactful contributions to startup growth.

How does the $23M Series funding compare to other investments in Bengaluru-based startups?

This funding stands out due to its scale and the involvement of high-profile investors like Dilipkumar.

How does Moneycontrol contribute to the startup landscape?

Moneycontrol offers in-depth coverage and analysis, bridging the gap between startups and potential investors.

What challenges do Bengaluru startups face despite high funding rounds?

Challenges include regulatory complexities, talent retention, and maintaining growth momentum.

What does the future hold for startups in Bengaluru and India as a whole?

The future is bright, with increasing investments, supportive policies, and a vibrant entrepreneurial spirit.